In May 2015, we conducted an online survey, employing the Italian National Election Studies online panel, where more than three thousand Italian participants have been asked to choose in pairwise comparisons between fiscal unions with different characteristics.

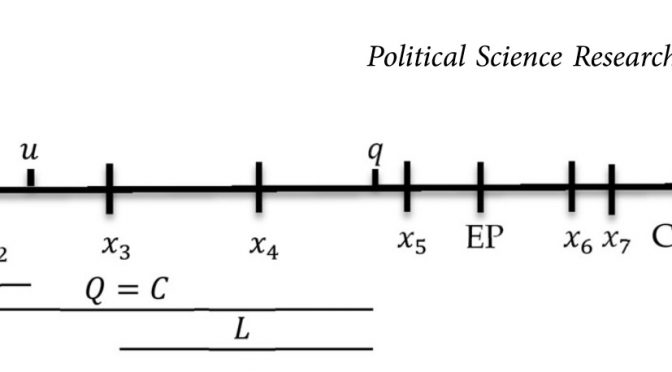

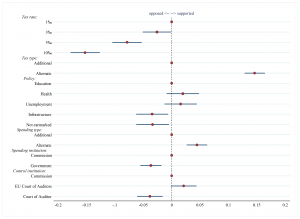

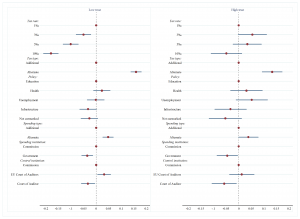

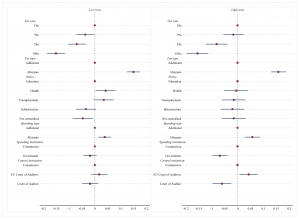

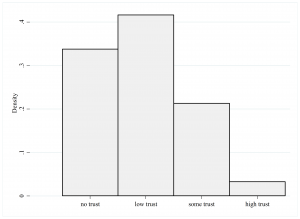

Although more than sixty percent of the participants declared their support for a fiscal union, even when made aware of its distributive implications, they systematically preferred unions with the lowest possible tax rate (Figure 1 – click on the figure to enlarge), note: a positive (negative) value means that a union with that characteristics is supported (opposed).

Figure 1: Attitudes toward fiscal unions with different characteristics

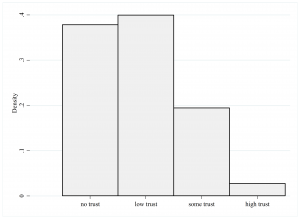

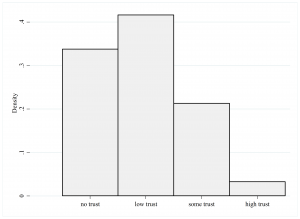

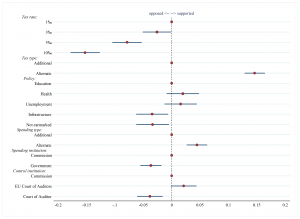

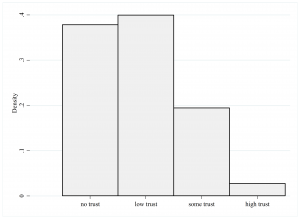

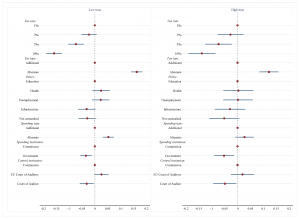

Among several other factors, it seems that attitudes toward the Greek government undermine support for a fiscal union. Trust in the Greek government is not high (Figure 2) and – importantly – attitudes toward fiscal unions vary between participants having low and high trust, at least with regard to the very important issue of the tax rate (Figure 3)

Figure 2: Trust in the Greek government

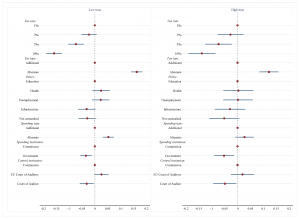

Figure 3: Trust in the Greek government and attitudes toward fiscal unions

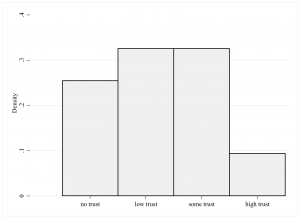

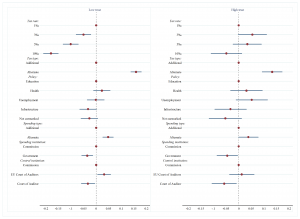

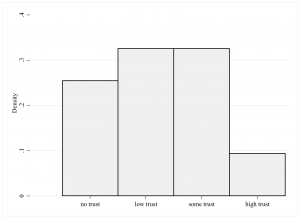

Trust in the Italian government is only marginally higher (Figure 4), but – importantly – attitudes toward fiscal unions do not vary significantly between participants having low and high trust (Figure 5)

Figure 4: Trust in the Italian government

Figure 5: Trust in the Italian government and attitudes toward fiscal unions

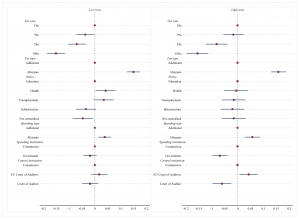

Trust in the German government is even higher (Figure 6), but – similarly – attitudes do not vary much between participants having low and high trust, with the possible exception of the spending priorities (Figure 7)

Figure 6: Trust in the German government

Figure 7: Trust in the German government and attitudes toward fiscal unions

In sum, participants are unwilling to pay for a fiscal union and these attitudes can be at least partially explained by the lack of trust in the Greek government.

Some of these findings have been presented in a paper written with Paolo Segatti (Università degli Studi di Milano) and presented at the Panel on Austerity Politics at the Crossroads, 5th Annual Conference of the European Political Science Association, Vienna, June 25 – 27, 2015